When you hear the words ‘personal finance’, what comes to mind? A complicated maze of numbers, terms like stocks and bonds, and perhaps an overwhelming sense of confusion? You’re not alone. For many, the realm of personal finance can seem daunting. But, just like any subject, breaking it down into bite-sized pieces makes it more digestible. Let’s embark on a journey into the basics of personal finance.

The Importance of Financial Literacy

Understanding money isn’t just about being able to count it; it’s about knowing how to manage, save, invest, and spend it wisely. Financial literacy equips us with the tools and knowledge to make informed decisions, avoid costly mistakes, and attain a stable and secure future. Imagine sailing a ship without a compass; that’s what navigating life without financial literacy feels like.

Starting with a Budget

1. Track Your Income and Expenses: Before you can plan for your financial future, you need a clear picture of your present. Make a list of all your income sources, be it from your salary, rental income, or freelance projects. Next, jot down all your monthly expenses – from rent and utilities to groceries and entertainment. This provides a snapshot of where your money comes from and where it goes.

2. Categorize Your Spending: Divide your expenses into fixed (like rent) and variable (like dining out). This helps identify areas where you can potentially cut back.

3. Set Financial Goals: Whether it’s buying a home, traveling, or retiring early, having clear goals will guide your budgeting process.

4. Review and Adjust: A budget isn’t set in stone. Regularly review it and make necessary adjustments. Maybe you got a raise or have new expenses; updating your budget ensures it remains relevant.

The Power of Saving

Saving money is the cornerstone of financial security. Here are a few reasons why:

Emergency Fund: Life is unpredictable. Having savings ensures you’re covered during unexpected events, such as medical emergencies or sudden job losses.

Achieving Goals: Whether it’s a vacation or a new car, saving is the pathway to reaching those goals without sinking into debt.

Retirement: No one wants to work forever. Saving consistently ensures you can enjoy your golden years without financial worries.

Debunking Debt

Not all debt is created equal. While it’s common to have loans or credit card bills, understanding them is key.

Good Debt vs. Bad Debt: A mortgage or student loan can be considered good debt because they can lead to wealth or income generation in the long run. On the other hand, high-interest credit card debt, often resulting from impulse buys, is usually categorized as bad debt.

Managing Debt: Always pay more than the minimum amount due on credit cards to avoid piling interest. Consider debt consolidation or refinancing options if you have multiple high-interest debts.

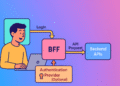

Investing: Your Money’s Best Friend

Money kept under the mattress (or even in most regular savings accounts) doesn’t grow. Investing, although it comes with risks, allows your money to work for you.

Start Small: Don’t wait until you have a large sum. Begin with a small amount and gradually increase your investment.

Diversify: The age-old saying, “Don’t put all your eggs in one basket,” holds for investments. Spread your money across different assets to mitigate risks.

Stay Informed: Markets change, and so should your investments. Regularly review and adjust your portfolio based on market trends and personal goals.

Conclusion

Navigating the world of personal finance might seem intricate at first, but once you understand the basics, the path becomes clearer. Remember, personal finance is just that – personal. What works for one person might not work for another. The key is to stay informed, seek advice when needed, and always be proactive about your financial health. It’s your money; take charge of it!