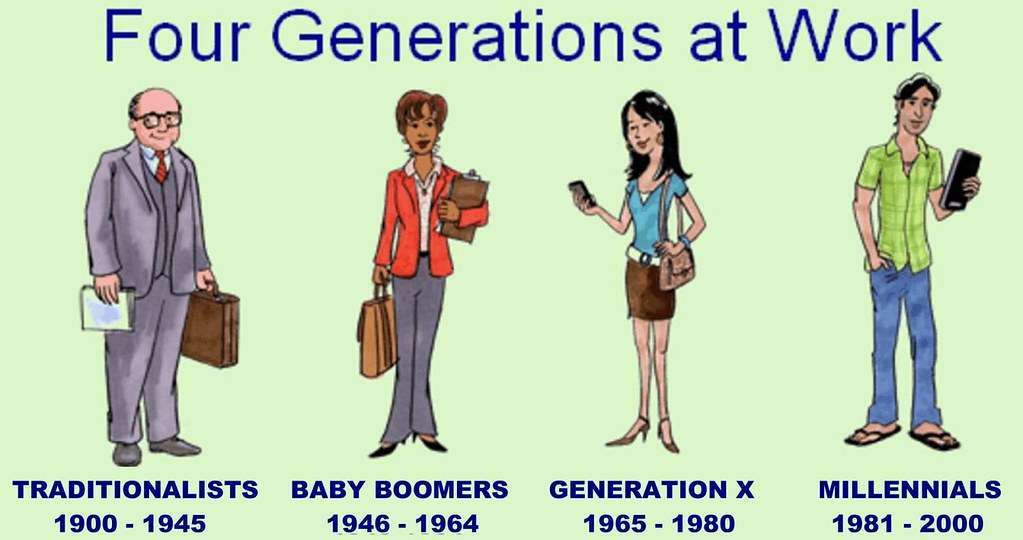

Today’s financial landscape has shifted dramatically from that of our parents’ and grandparents’ generations. Millennials, the cohort born between 1981 and 1996, are grappling with a slew of unique financial challenges that Baby Boomers, born between 1946 and 1964, may not have encountered to the same extent. From climbing student debt to housing affordability crises and the uncertain future of social safety nets, it’s evident that millennials face an uphill battle in their savings journey. Let’s delve into why millennials might need to save twice as much as boomers did.

1. Higher Education Costs:

Over the past several decades, we’ve witnessed a dramatic and alarming surge in the cost of education, transforming the financial dynamics for countless individuals seeking higher learning. The College Board’s data offers a telling snapshot of this escalating concern: Between the years 1988 to 2023, the figures reveal that the average annual fees for a private four-year college did not just increase gradually, but instead, they astonishingly more than doubled. This exponential rise in educational costs hasn’t just been a statistical observation but has had tangible consequences on the real-world financial burdens of the younger populace. For millennials, the generation that came of age during this period of spiraling tuition fees, the repercussions have been profound. They find themselves saddled with student loans at a magnitude that was largely unprecedented for the generations before them. The dreams and aspirations of many in this cohort have been overshadowed by the looming specter of student debt, making them the unfortunate bearers of a financial burden heftier than that shouldered by any preceding generation.

2. Housing Affordability Crisis: The aspiration of homeownership, once a widely accepted hallmark of reaching adulthood and achieving personal financial stability, is morphing into a distant mirage for numerous millennials. This generational shift isn’t just an anecdotal sentiment; it’s grounded in the economic realities that millennials grapple with. A troubling juxtaposition has emerged, characterized on one side by wages that have largely remained static, failing to keep pace with the increasing demands of contemporary living, and on the other side, the meteoric rise in property prices across various regions. This surge in real estate value, while beneficial for existing property owners, erects formidable barriers for those hoping to step onto the property ladder. The result? Millennials, even those with stable jobs and reasonable incomes, are finding themselves in a financial quagmire, where the dream of owning their own abode seems more fantastical than feasible. In stark contrast, the baby boomer generation, millennials’ predecessors, had navigated a rather different economic landscape. For them, the ratio of income to property prices was more balanced, making homeownership a more attainable and less daunting endeavor. This disparity between the two generations underscores a broader socio-economic shift, where the dream of owning a patch of earth to call one’s own is slipping further out of reach for many young adults.

3. The Changing Retirement Landscape: Pensions, once a hallmark of retirement planning, are on the decline. Instead, more responsibility has shifted to the individual through vehicles like 401(k)s. This means millennials need to be more proactive and disciplined about saving for their golden years.

4. Increased Life Expectancy: Advances in healthcare mean people are living longer. While this is a cause for celebration, it also means millennials will potentially have more years of retirement to fund than boomers.

5. Uncertainty of Social Safety Nets: Social Security and Medicare have been critical safety nets for previous generations, but their long-term financial viability has come into question. Many experts believe that these programs may not be sustainable in their current forms by the time millennials reach retirement age. This uncertainty has left many individuals concerned about their future financial security and has led to discussions about potential reforms to ensure the continued existence of these safety nets.

6. The Effects of the 2008 Financial Crisis: The 2008 financial crisis had a significant impact on many millennials who entered the job market during or after that time. These individuals not only faced challenges in terms of their initial earning potential but also had to deal with the potential long-term effects on their overall lifetime earnings and savings potential. This is just one example of the many ways that economic events can have a lasting impact on individuals, families, and communities. As we move forward, it is important to be mindful of these impacts and work towards creating a more equitable and sustainable economy for all.

7. Rise of the Gig Economy: One of the downsides of taking on flexible, gig jobs is that they often lack the benefits that come with traditional full-time jobs. For example, there may be no retirement savings matches, no health insurance, and no job security. As a result, millennials who choose to pursue this type of work may find themselves with less automatic savings and more out-of-pocket expenses.

8. Increasing Healthcare Costs: As medical care costs continue to rise, millennials are being urged to save more to prepare for any unexpected health emergencies and future medical needs. With the average cost of healthcare constantly increasing, it’s important to ensure that you have enough savings to cover any unforeseen medical expenses that may arise.One way to prepare for these costs is to contribute to a health savings account (HSA), which is a tax-advantaged savings account specifically designed for medical expenses. Another option is to set up an emergency fund specifically for medical expenses. This fund should ideally cover at least six months of expenses, including rent/mortgage, utilities, and other necessary bills.In addition to saving for medical expenses, it’s also important for millennials to prioritize their health and well-being. This can include maintaining a healthy diet, getting regular exercise, and going for annual check-ups and screenings. By taking care of their health, millennials can potentially reduce their risk of developing medical conditions and therefore lower their medical expenses in the future.By being proactive and prioritizing their health and financial well-being, millennials can better prepare themselves for any unexpected medical expenses that may arise.

8. Inflation: Inflation is a phenomenon that affects all generations, regardless of age. The gradual increase in the general price level of goods and services can have a significant impact on the purchasing power of money. It means that the money you have today might not be worth the same in the future. This is why it’s essential to consider the long-term value of your savings when making financial decisions.For example, if you think you’re saving a considerable amount of money by cutting back on expenses, it may not be worth as much as you think in the future. This is because inflation can erode the value of your savings over time, reducing the real purchasing power of your money. It’s crucial to keep this in mind when planning your financial future, especially if you’re saving for retirement or other long-term goals.One way to combat the effects of inflation is to invest your money in assets that appreciate in value over time. These assets can include stocks, real estate, or precious metals. By investing in these assets, you can potentially grow your wealth and keep up with inflation over time. However, it’s essential to remember that investing comes with risks, and you should always do your research and consult with a financial advisor before making any investment decisions.In conclusion, inflation is a factor that can significantly impact the value of your money over time. It’s important to consider the long-term effects of inflation when making financial decisions and to plan accordingly. By investing in assets that appreciate in value, you can potentially keep up with inflation and grow your wealth over time. However, it’s crucial to remember that investing comes with risks and to seek professional advice before making any investment decisions.

10. Desire for Experiences: In today’s society, many millennials are placing a higher value on experiences rather than material possessions. This shift in priorities can be seen in the increasing number of young adults choosing to spend their money on travel, attending music festivals, or dining out with friends. While these experiences can be incredibly fulfilling and provide memories that last a lifetime, they often come with a hefty price tag that can divert funds from long-term savings.It’s important to consider the long-term financial implications of prioritizing experiences over savings. While it’s great to live in the moment and enjoy life, it’s also crucial to plan for the future. Saving money for retirement, a down payment on a house, or an emergency fund should also be a priority. By finding a balance between enjoying experiences and saving for the future, millennials can ensure that they are building a solid financial foundation for themselves.One way to strike this balance is by setting a budget for experiences and sticking to it. By planning ahead and deciding how much money to allocate for travel or other experiences, millennials can avoid overspending and ensure that they are still saving for the future. Additionally, looking for ways to save on experiences, such as using travel rewards or attending free events, can help stretch the budget even further.Ultimately, it’s up to each individual to decide how they want to prioritize their finances. While experiences can be incredibly enriching, it’s important to remember the value of saving for the future. By finding a balance between the two, millennials can enjoy the best of both worlds and build a financially secure future.

What Can Millennials Do?

Recognizing these challenges is the first step. Millennials are advised to start saving early, diversify their investments, take advantage of employer-sponsored retirement plans, and regularly review and adjust their financial strategies. Embracing financial literacy and seeking advice from financial planners can also pave the way for a more secure financial future.

In conclusion, millennials must take a proactive approach to their finances to ensure a comfortable future. By recognizing the need to save more and acting on it, they can begin to build a secure financial foundation. With a combination of awareness, planning, and discipline, millennials can manage their complex financial landscape and build a buffer to help them weather any economic storms. This means budgeting, taking advantage of employer-sponsored retirement plans, and having an emergency fund to provide a financial cushion. Additionally, millennials should explore financial products, such as stock options or mutual funds, to help grow their savings. With the right strategies in place, millennials can reach their financial goals and have a secure future.

For those in search of the latest insights, trends, and buzz, you’re in the right place at ItzNews. Explore our curated list of must-read articles:

- 🌐 For a look into the future of technology: Werner Vogels’ Tech Predictions for 2023: A Deep Dive

- 💧 Interested in enhancing your well-being? Don’t miss The Power of Water: Harnessing its Benefits for Optimal Human Health

- ⚽ Sports aficionado? Stay updated with Premier League transfer news featuring Cristiano Ronaldo and top clubs

Dive into these topics and more to stay informed, enlightened, and entertained.